Making Solar Power Affordable For All

Incentives to go solar in Pennsylvania.

SOLAR NET METERING IN PENNSYLVANIA

Your solar panels will often produce more electricity than you need, but thanks to Pennsylvania’s net metering policy, you will be able to sell this back to the grid in exchange for credits on your utility bill. When you need more electricity than your panels are producing, you can use those credits instead of buying electricity from your utility.

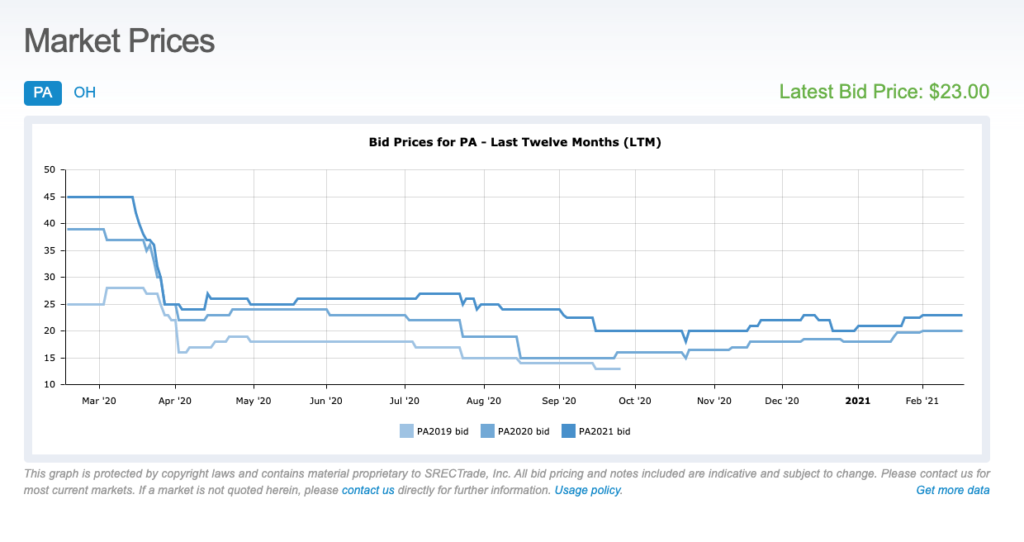

SOLAR RENEWABLE ENERGY CREDITS (SRECs)

PA offers an SREC program to homeowners who go solar. SRECs, also known as Solar Renewable Energy Credits, let you earn credits for every kilowatt-hour (kWh) of solar energy your system creates. Each year, you could make money by selling your solar credits in the SREC market. For each megawatt hour (or 1,000kWh) of electricity your solar panels produce, you will be granted one SREC that you can sell for extra cash. See latest market prices here.

FEDERAL TAX INCENTIVES

Federal Solar Tax Credits for 30% of the installation cost is applicable to all solar installations. Also, there is accelerated depreciation for commercial applications that can assist in moving to clean, renewable energy.

As per our standard operating procedure, we advise each customer talks with their tax professional.

ZERO DOWN, ZERO % FINANCING

Going Green Won’t Cost You Green. Solar Liberty can help you start saving with your residential solar power system installation in Pennsylvania, as we require little or no money upfront. We offer a number of flexible financing options to meet your specific needs.

Solar Liberty services the State of Pennsylvania with crews operating out of Altoona, Erie, Harrisburg, Pittsburgh, Scranton, and State College.