The Federal Solar Tax Credit Explained

Most people know about renewable energy because of its importance in climate change. Solar, hydro, and biomass are never-ending energy sources. However, one thing homeowners should know when considering renewable energy in their lives is the financial incentive. Solar energy, as well as other renewable energies, have tax credits that help reduce household financial burden. This is called the Federal Solar Tax Credit. Here is the Federal Solar Tax Credit explained, as well as information about if you’re eligible for it.

What Is the Federal Solar Tax Credit?

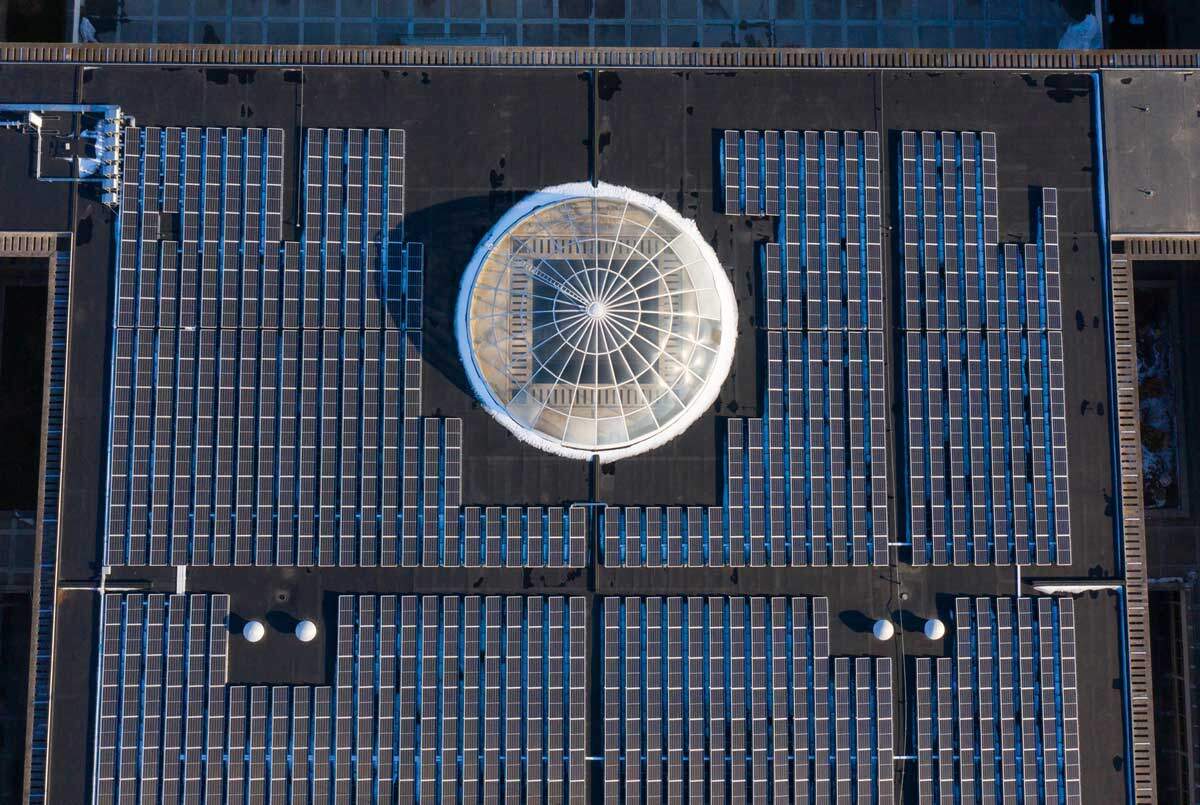

The Federal Solar Tax Credit/ FSTC (or the Investment Tax Credit/ ITC) is a tax credit given to homeowners with photovoltaic panels to promote solar energy consumption. A tax credit is a dollar for dollar reduction in the amount of income tax an individual owes. There are similar credits for other renewable energies but solar is the most common. Homeowners must have their panels installed within the tax year to receive the credit. Systems installed in 2020 will receive a 26% credit and 22% in 2021. It is set to expire in 2022, unless renewed.

How It Can Help You

The FSTC accounts for many expenses. These include the solar PV panel, contractor labor costs for onsite installation, system equipment, and even energy storage devices. Anyone can claim the tax credit if they meet the following requirements: they are the homeowner or landlord, it is installed on a residence or vacation home, and is installed on the owner’s roof or property—note that this is not a comprehensive list, and you should check the guidelines thoroughly before installation. The tax credit does not apply to leases or community solar programs, depending on how they’re structured.

How to Claim the FSTC

Once determined that you are eligible for the Federal Solar Tax Credit, you can claim the IRS Form 5695 to your federal tax return. You can find these forms on the IRS website or learn more with this link. Inform your accountant or professional tax service that you’ve switched to solar energy and they can help you with this rebate.

Call us at Solar Liberty for your solar panel installation services; if you need an experienced and professional solar energy equipment supplier, we are here to help. We rank as the largest solar installer in New York State. Let our experience installing almost 3,000 solar arrays work for you. Don’t delay—switch to renewable energy today. Call us today on our 0% interest loans so that you have an even greater financial incentive to switch.